ISSUE#29 PAYMENTS TAKING CENTRE STAGE SWIFT ACTION ON CBDC s SOFTWARE-AS-A-SERVICE A SASSY APPROACH TO SaaS FRENCH STARTUP SWAN SHAPES BANKING WITHOUT BANKS ENTREPRENEURSHIP SUCH SWEET SORROW CAZENOVE CAPITAL ON WHAT MAKES A GOOD EXIT Swift ● BBVA ● N26 ● PWC ● Bottomline ● SunTec ● Temenos ● Exactpro Mambu ● Tuum ● Lanistar ● Fazil ● BNY Mellon ● ING ● Intix ● PPRO ● OakNorth ● Ageras INSIGHTS FROM SmartStream’s Haytham Kaddoura and Peter Dehaan on how real-time treasury management could help prevent another SVB

Experience composable banking with Mambu's SaaS cloud banking platform.

Learn more

FINTECH FOCUS

14 The dangers of LLMs

Writer Stuart Thomas is a tech fanatic but even he is cautious about letting generative AI loose in financial services. Here’s why

26 Debanking uncovered: trust, tech & conspiracy theories

We look at the latest controversy to undermine faith in UK banking and ask: if technology turns out to be the problem, could it also be the answer?

44 Open season

The European finance ecosystem is readying itself for a new legislative payments package. Tim Goodfellow listened to what you make of the proposals

48 We can’t get no satisfaction

Ron Delnevo considers the UK Treasury’s policy statement on cash access and questions why the wishes of 50 million Brits are being ignored

62 Looking for the exit

Cazenove Capital holds founders’ hands as they head to the door. So, what’s the role of the wealth manager in an exit and how do you say goodbye?

79 Sticks and carrots

A sample of how regulators around the world take different approaches to fintechs

82 Access for all: the inconvenient truth

One billion people with some form of impairment routinely have their life chances limited by poor access to financial services. A G+D-hosted roundtable looked at how the industry could be more empathetic

THEFINTECHVIEW

Any fintech founder who’s ever struggled to make a raise, sweated over pitch decks, pored over cashflow forecasts and prayed they don’t run out of runway before they gain some height, must have felt a tinge of envy, surely, watching the biggest IPO of the year this month (September).

While British semiconductor and software maker Arm, which made its debut on the Nasdaq with a $54billion valuation, isn’t a financial services provider, without it, mobile banking as we know it, simply wouldn’t exist. Arm CPUs are used in 99 per cent of premium smartphones worldwide. And it’s principal investor is Japan’s SoftBank, the same VC whose Vision Fund has driven expansion at Chime, Clearco, Klarna, Kabagge, PayTM, OakNorth, Revolut and Zopa, among a host of other fintechs.

The fund’s portfolio is comprehensive, covering insurtech, paytech, lendtech, wealthtech, crypto, blockchain… the list goes on. SoftBank is vast and vastly influential – but not so big that its high-risk bets didn’t see the Vision Fund investment arm hammered over five

ISSUE#29 l 2023

consecutive quarters by the prevailing high-interest rate environment.

That only came to an end in August when it announced a gain of $1.1billion, reversing more than a year of lacklustre performance.

By then, it had sold its interest in Uber, which only turned cash positive this year. And it wasn’t listed as taking part in Klarna’s raise last year when the lentech’s valuation tumbled.

Trying to figure out a capital raising strategy, much less an exit strategy, in these times is hard. But whereas three years ago, investors were looking for growth at all costs, the consensus of opinion in this issue of The Fintech Magazine is that strong liquidity and cash management is now key. Get that right and you could be the next Arm.

Our last issue’s spine-tingler, “We need not wait to see what others do,” was by Mahatma Gandhi, an Indian lawyer, anti-colonial nationalist and political ethicist who led the successful campaign for India's independence from British rule (1869-1948).

Sue Scott, Editor

CONTENTS

Issue 29 | TheFintechMagazine 3 48 16 6 14

CASH & LIQUIDITY MANAGEMENT

6 Navigating a new world of liquidity management

After the GFC, we thought the world’s banking system was secure… SmartStream’s Peter Dehaan discusses what’s changed and how financial institutions should respond

8 Putting treasury in the pilot seat

The changing role of the treasurer demands flexible, innovative solutions that will have an impact on the strategic direction of not only the bank but also its corporate clients, says SunTec Business Solutions

11 Restyling corporate banking

The changing role of the corporate treasurer has resulted in new demands on their bank. BNY Mellon tells us what life is like on the other end of that relationship

ARTIFICIAL INTELLIGENCE

16 Keeping a finger on the pulse

As CEO of SmartStream, Haytham Kaddoura has an insider’s view on how recent events in the US are impacting cash and capital management – and how AI can improve it

18 Closing ranks on fincrime

Five Dutch banks are establishing a transaction monitoring utility that aims to move the dial on anti-money laundering through data-sharing and sophisticated AI. ING is one of them

21 Inside the AI Factory

Spanish bank BBVA has just set up its second technology hothouse as part of an ambitious tech strategy that will also see it hire thousands more IT professionals in 2023

24 Good testing and how to achieve it

GenAI can improve testing of financial software, but you need to balance its creativity with rule-based models, says Exactpro

PAYMENTS

30 Taking centre stage

As more central banks prepare to issue their own CBDCs, Swift’s Nick Kerigan explains how the global payment messaging service is working on cross-border technology to support them

32 A Nordic cliffhanger

The Nordics’ P27 cross-border payments project has been halted, but the problems it set out to solve remain. Bottomline is helping the region address them

35 The Google of payments

Intix on banks’ growing opportunities around data

38 Local heroes: the key to cross-border success

Keeping up with consumers’ local payment preferences, especially if you’re trading internationally, is a pillar of long-term success. PPRO is at the heart of that SOFTWARE-AS-A-SERVICE

51 The stealth approach to transformation

Banks aren’t interested in hugely disruptive (and hugely expensive) rip-and-replace technology programmes. But what’s the alternative? Mambu has a cunning plan…

55 Powering choice

Tuum, one of the new-generation core banking providers, is making remarkable progress by providing a super-flexible platform on which others can build the future

59 Plugged into success

There’s mounting existential pressure on banks, but that’s not a reason to slow SaaS migration, says Bottomline

60 SME banking… without banks

Wrapping banking up with other business management tools could have a transformative impact on SMEs, as Ageras and Swan are demonstrating CHALLENGERS

68 How to win friends and finfluence people

Lanistar launched on the back of a unique Instagram campaign in the UK before leaving to make its mark in Brazil. Now it’s preparing to return

70 Coming down to earth

N26 was enjoying stratospheric growth when it had its wings clipped by the German financial regulator. Today, it’s more grounded, but in a good way, says Pablo Reboiro

73 Steadfast & true

UK challenger OakNorth has grown from the acorn of an idea into a flourishing fintech, more than capable of withstanding harsh conditions

76 Easy banking for happy spending

Fazil is the Spanish challenger chasing a 500-million-person prize. It’s got a way to go, but it’s not lacking ambition

LAST WORDS

86 Sky-high and scary

Incidents of both authorised and unauthorised fraud have fallen slightly, but that’s no comfort to victims like our own Doug Mackenzie

4

CONTENTS

TheFintechMagazine | Issue 29 ffnews.com All Rights reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, photocopying or otherwise, without prior permission of the publisher and copyright owner. While every effort has been made to ensure the accuracy of the information in this publication, the publisher accepts no responsibility for errors or omissions. The products and services advertised are those of individual authors and are not necessarily endorsed by or connected with the publisher. The opinions expressed in the articles within this publication are those of individual authors and not necessarily those of the publisher. THEFINTECHMAGAZINE 2023 ISSUE #29 EXECUTIVE EDITOR Ali Paterson GENERAL MANAGER Chloe Butler EDITOR Sue Scott PRODUCTION Taylor Griffin Trinity Yau HEAD OF CONTENT Douglas Mackenzie HEAD OF MARKETING Ben McKenna CONTACT US ffnews.com DESIGN & PRODUCTION www.yorkshire creativemedia.co.uk ART DIRECTOR Chris Swales PHOTOGRAPHER Jordan “Dusty” Drew ONLINE EDITOR Lauren Towner ONLINE TEAM Joshua Hackett FEATURE WRITERS David Firth l Tracy Fletcher Tim Goodfellow Martin Heminway Alex King l Natalie Marchant Doug Mackenzie Fiona McFarlane Martin Morris l James Tall Frank Tennyson Stuart Thomas l Sue Scott Fintech Finance is published by ADVERTAINMENT MEDIA LTD. Pantiles Chambers 85 High Street Tunbridge Wells, TN1 1XP ACCOUNTS TEAM Jacob Bruce l Tom Dickinson Shaun Routledge Emillie Snelgrove VIDEO TEAM Lewis Averillo-Singh Alexander Craddock Max Burton l Luke Evans Louis Jean La Grange IMAGES BY www.istock.com PRINTED BY Print it 24 seven "PROUDLY NOT ABC AUDITED" 70 18

“If you mismanage your capital, you’re going to die a slow death. If you mismanage your liquidity, it’s like dying of a heart attack,” says Peter Dehaan, global head of cash and liquidity management at technology solutions company SmartStream, and the man responsible for the firm’s cash and intraday liquidity pillar.

He’s reflecting on the spate of US banking collapses earlier this year, which sent shockwaves across the global financial system. The failures of Silicon Valley Bank (SVB) and Signature Bank plunged many companies into alarming credit and liquidity crises, bringing banks’ liquidity management sharply into question.

“That’s what treasurers are more focussed on now,” says Dehaan, “because that’s going to catch up with you faster than mismanaging your capital.”

RISING RATES AND CHATTER

As exposed spectacularly by the SVB implosion, it’s become even more important to appropriately manage liquidity in an age of rising interest rates and fevered social media use.

“Rising interest rates are playing a significant part,” acknowledges Dehaan. “When rates were zero, or next to nothing, there was a certain amount of discipline required to manage your money, but

whether you were massively long or massively short didn’t really make much difference. Now the rates are above five per cent in the UK and the US, it becomes a more expensive hobby. So you need to be more careful about managing your funds.

“We now also have the social media effect. You have uninformed people advising uninformed people what they should or shouldn’t do with their money.”

Dehaan believes that panic spread across social media only serves to accelerate bank runs. SVB’s will go down in history as a record-breaker, with $42billion withdrawn by depositors in just 10 hours.

“As a comparison, in 2008, Washington Mutual lost around $16billion across a nine-day period,” points out Dehaan.

The Federal Reserve has concluded that the bank’s failure was due to a ‘textbook case of mismanagement’, claiming its leadership neglected to manage basic interest rate and liquidity risk.

It’s worth noting that the report also calls into question the Fed’s own regulatory failings, adding that ‘Federal Reserve supervisors failed to take forceful enough action’. It chooses not to point out that the same long-term government bonds that it criticises SVB for failing to hedge against when interest rates shot up and quickly eroded their value, are the same ones the Fed is majorly invested in.

Dehaan is clearly in no doubt that the US bank failures can be attributed to both the mismanagement of intraday liquidity

and the regulatory framework in the US that allowed it to happen: many commentators have accused the Fed of hiking interest rates ‘until something breaks’.

“Treasurers and the regulators have to get much better at managing intraday liquidity,” says Dehaan, “and ask what are you looking at? Are you looking at projected or actual data? In general, there’s been little to no investment in this area over the last 10 to 15 years. The time has now come for this to be addressed.

“The way I see it, you have three choices – the three Bs. Do you Bolster the systems that you have already – essentially, putting sticky tape on what’s there? Do you Build? If you’re a Tier 1 name, yes, you can probably afford to build. But if not, you have to Buy – so then you’re looking to partner with a trusted adviser who can help you to complement and boost the systems you have in place.”

Both SVB and Signature Bank were small in comparison to the nation’s largest banks, yet the shock they created, along with the Credit Suisse saga in Europe, has drained a large amount of confidence out of the incumbent financial system. And maybe that’s not misplaced.

“It goes back to antiquated and fractured infrastructure,” says Dehaan. “I was speaking to some treasury people recently, and someone told me they only had a 50 per cent confidence level in their positions at any point in the day. So that shouldn’t be

CASH & LIQUIDITY MANAGEMENT: POST-SVB

After the GFC, we thought the world’s banking system was secure… SmartStream’s Peter Dehaan discusses what’s changed and how financial institutions should respond

6 TheFintechMagazine | Issue 29 ffnews.com

filling you with confidence. It all boils down to the fact that the more information you can pull into the centre, the better armed you’re going to be.

“The more ledger information that you can consume, and the more debit and credit information you consume, the better. It enables you to match these off, in a real-time fashion, and move forward from there.”

A REGULATORY RETHINK

Looking to the future, banks may well now find regulators insisting on smarter liquidity management. Indeed, the wheels are already in motion. The ink is barely dry on Basel III, the latest international regulatory framework for banks that completed its long roll out in January 2023, and there are already plans to change the capital requirements linked to it in the US.

In July this year, the Federal Reserve, Federal Deposit Insurance Corporation (FDIC) and the Office of the Comptroller of the Currency, unveiled plans that would require banks with at least $100billion in assets to boost the amount of capital set aside by an estimated 16 per cent. Under the proposals, midsize banks would also now have to include unrealised gains and losses from some securities in their capital ratios. And there will be stricter ways of calculating risk-based assets.

Martin Gruenberg, chairman of the FDIC had previously said that it was possible

SVB might not have failed if these rules had been in place then.

It's also been reported that the Basel Committee on Banking Supervision is to review the entire Basel III package ‘in flight’. In April, Bank of England Deputy Governor Sam Woods told lawmakers that bank liquidity rules may now be ‘an open question for international policy makers’. The industry seems to agree. In a note to clients, PwC echoed the regulatory sentiment, predicting that banks with between $100billion and $250billion in total assets can soon expect changes around capital adequacy, total lossabsorbing capacity, liquidity requirements, resolution planning, and the impact of

and still be below. So I’m expecting that to become tiered soon.”

THE PURSUIT OF RETURNS

There’s also a growing awareness that real-time liquidity management affects the entire asset and liability management strategy. Real-time data allows firms to alter their investment strategy to ensure they have sufficient liquidity buffers by constantly rebalancing high and low-risk assets to match their liabilities.

Consultancy group Finalyse is among those to highlight that the concept of asset and liability management focusses on the timing of cash flows because company managers must plan for the payment of liabilities. Calling liquidity ‘the lifeline of financial institutions’, Finalyse points out that the pursuit of additional returns isn’t sustainable without ensuring a robust liquidity management strategy is in place.

And this is where the SmartStream platform adds real value, giving institutions a real-time, rather than projected, assessment of their liquidity position.

accounting for unrealised gains or losses in securities portfolios.

“European banking regulation is a lot tighter than what happens in the US,” says Dehaan. “Loose regulation fed into how the collapses played out. So they need to revise the regulation, and I expect that to be sooner rather than later. Where the thresholds are at, you can have $249billion

“Boards and regulators are going to be increasingly asking ‘how do you manage your money?. Do you have a handle on it?’,” says Dehaan. “I was speaking to one institution recently, and they said their current state is managing their intraday liquidity on Excel, but they didn’t want this to be their future state.”

Nor perhaps should it be if they want to avoid the liquidity crunches that can so easily derail them.

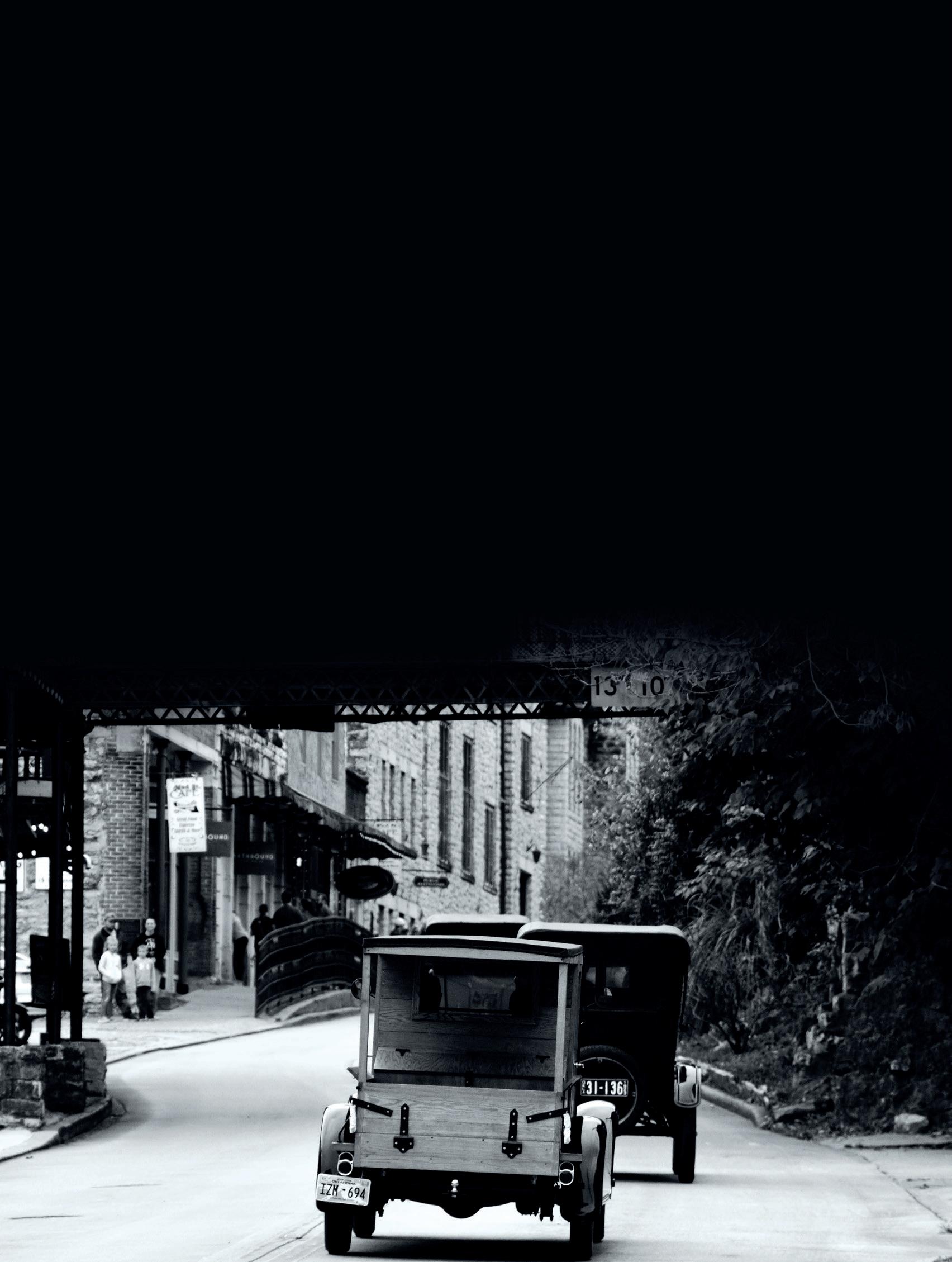

Peaks and troughs: A resilient liquidity management strategy is essential

7

Treasurers and the regulators have to get much better at managing intraday liquidity. There’s been little to no investment in this area for 10 to 15 years

ffnews.com Issue 29 | TheFintechMagazine

In the not-so-distant past, helicopter pilots faced a daunting array of tasks that demanded their expert manual control and attention to stay in the air.

From the moment they took off, they had to skilfully control the helicopter's lateral and longitudinal movements and maintain constant awareness of its altitude, speed and the ever-changing environmental conditions, all the while keeping a close hand on the throttle, as they navigated a path from A to B.

Today, a suite of automations have simplified these tasks, minimising the collection and management of the information required and allowing pilots to focus their attention on plotting the best route to their destination. Now substitute ‘pilot’ with ‘treasurer’.

The treasurer’s role has similarly been transformed. Enormous developments in Cloud-based digital services are empowering data-driven treasurers to take more responsibility for steering their organisation’s direction of travel as the financial climate changes.

Cutting-edge digital applications are freeing dynamic treasury teams from the routine tasks associated with cash forecasting, payment reconciliation and liquidity management, allowing them to reallocate time to tactical planning, strategic thinking and a vocal role in environmental, social and governance (ESG) work. They are functioning at an altogether higher corporate altitude.

In organisations that embrace this change, a treasurer will be obliged to spend less of their time ensuring their organisation stays aloft, and more time guiding the business forward. This revision of established roles is being endorsed by some of the sector’s most authoritative thinkers, and, in light of these changes, banks would seem well-advised to re-evaluate how they enable not only their own treasurers, but also those of their corporate clients.

Many treasury teams will tell you that the pain-points that have historically tethered them to the desk are cash forecasting, risk management, and bank relationship management, all time consuming, data-intensive tasks with serious consequences if delivered without accuracy. Monitoring these factors in order to keep cash flow in check will remain the treasurer’s area of expertise, but the latest solutions give them easy and timely visibility on these metrics.

Tasks that used to rely on a bevy of human analysts can now be achieved with Cloud-based software that plugs into existing infrastructure – and that is key

to simplifying the suite of treasurer responsibilities. By allowing digital stewards to deliver a more easily visible overview of what’s happening to liquidity at a given point in time, treasurers can focus more attention on looking ahead. In the words of certified treasury professional Dan Gill: “Cash is always king, but visibility is queen.”

Gill, the industry principal for banking and financial services at enterprise software product and SaaS company SunTec Business Solutions, notes that liquidity and risk management – the treasurer’s backroom skill set – are now strategic imperatives for many companies.

“With interest rates having been near zero for so long, many organisations do not have the experience or systems in place to effectively manage liquidity or interest rate risk,” he says. “Corporate boards have become keenly aware of those risks and that has served to elevate the role of treasury.”

In this elevated role, treasurers are now becoming involved in areas that traditionally have been outside of their scope, he says.

“This is especially true in the ESG realm where the treasury team must now consider the environmental, social and governance impacts of their liquidity management decisions along with the traditional focus of yield and risk management.

“To effectively manage all these factors, treasurers need real-time visibility into yields and risks along with a variety of new factors, like ESG scoring, that is not yet fully matured. I believe that the banking industry holds the key to gathering, standardising, and delivering this new information to corporate treasury.”

CASH & LIQUIDITY

MANAGEMENT: SOFTWARE-AS-A-SERVICE

8 TheFintechMagazine | Issue 29 ffnews.com

The changing role of the treasurer demands flexible, innovative solutions that will have an impact on the strategic direction of not only the bank but also its corporate clients, says Dan Gill from SunTec Business Solutions

Gill knows that, for many corporate treasurers, it’s not a case of identifying which tasks are ripe for change, but how to implement the cutting-edge solutions needed to liberate treasury personnel, and expand the information available to them.

“Many treasury organisations continue to forecast cash and operations in outdated spreadsheets that operate days or weeks in arrears,” he says. “The world moves too fast now for these outdated methods.”

Fortunately, the scalable, compatible and open nature of the SaaS model means adopting a new software solution is more accessible than at any time previously.

Companies like SunTec offer an easy-to-implement solution for bringing new solutions to established banks, in a manner that is agile, accurate and deployable. With an API-led application, corporate banking teams looking to enliven their tech stack can integrate with an externally built, but locally managed suite of applications.

This eliminates the need to persuade in-house engineering teams to build each new application, and the need for those same in-house engineering teams to provide continuing development and support throughout that solution’s lifetime.

In this way, banks have an opportunity to have the best of both worlds – the stability of a major financial institution, with a fintech-like agility to deploy cutting-edge systems. And with these solutions comes the ability for corporate treasury systems to connect directly with financial institutions through APIs to keep relevant information at the treasurer’s fingertips where immediate action can be taken.

“I am a firm believer in adopting solutions that are future-proofed, built by subject matter experts with easy interoperability,” says Gill. “Integration between disparate systems is now far easier with the advent of standardised APIs, streaming technologies, and integration methods that easily outpace the batch-based methods that are rampant in so many financial institutions.”

A specialist in relationship pricing, working with banks and corporates to introduce more automation and transparency to that relationship, SunTec is using technology to build value for both parties. One of its most innovative ways in which it does that is through its Account Analysis Solution, which enables management of the entire corporate customer lifecycle, from origination, through implementation, pricing, billing and collections to renewals. It also allows banks to quickly deploy valuable offerings to their clients, such as Green-ECR, which gives customers the ability to purchase carbon credits through a balance offset, or directly through fees, allowing banks to

The coming years are likely to see an even more explosive expansion in the capabilities these systems offer and, for the transaction banking industry as a whole, this may represent an opportunity to regain some of the momentum lost in 2020. That was a year in which the industry took a dip so profound that it is thought to have wiped out three years of sector growth.

Indeed, as interest rates around the world rocket up from 15 years of historically low levels, adopting new and ambitious approaches to attract balances will become increasingly important, especially for small and mid-sized transaction banks.

“Small and mid-sized banks definitely face some significant headwinds in our current environment,” says Gill. “This will ultimately lead to a certain level of consolidation that could result in a lower level of service to the market. But I remain bullish on the role of small and mid-sized banks in the future, if they can act quickly.”

He believes highly flexible, SaaS-led innovations can offer a dynamic, ambitious and agile bank an opportunity to expand its services far beyond the capabilities of its nearest competitors, and at rapid pace.

Though it may not always be profitable to offer the highest rate available to customers on the market, insight-driven, tech-based offers could come to the fore, such as hyper-personalised individual rates, or tier-based rate offerings, says Gill.

compete more effectively for deposits while also meeting a strategic real-world challenge for their clients.

Meanwhile, the solution offers a first-of-its-kind, real-time mode for delivering balance positions and fee information. The SunTec Ecosystem Management module further allows comprehensive partner management and revenue settlement with other non-banking and third-party partners in an ecosystem.

For small and mid-sized banks unable to out-complete their larger competitors, playing smart on rates could prove the path to continue attracting customers and avoid becoming a victim of consolidation.

“Attracting new customers is essential, as is increasing the balances of current customers,“ Gill adds. “Simply offering the highest rate to all customers will likely not get the desired result as the cost for those deposits would be too high.

“Banks need to implement far more innovative solutions for rate management that allow them to hyper-personalise the rates that they offer to their customers by dynamic segmentation, that considers the customer’s entire relationship with the bank.”

9 ffnews.com Issue 29 | TheFintechMagazine

Cash is always king, but visibility is queen... the banking industry holds the key to gathering, standardising, and delivering this new information to corporate treasury

ARE LEGACY SYSTEMS HOLDING YOU BACK?

IF YOU’RE READY TO EVOLVE, WE’LL GET YOU TO THE FINISH LINE. FAST. Our cloud payments as a service allows you to accelerate innovation and serve your customers like never before. So, what’s holding you back? Visit volantetech.com.

IF YOU’RE READY TO EVOLVE, WE’LL GET YOU TO THE FINISH LINE. FAST. Our cloud payments as a service allows you to accelerate innovation and serve your customers like never before. So, what’s holding you back? Visit volantetech.com

FREEDOM TO EVOLVE

Restyling corporate banking

The digital landscape has changed certain expectations in corporate banking. Treasurers are looking for greater assistance with optimising their liquidity in a challenging market, and they’re looking to banks to help shoulder the load. It’s a big task, even for a financial juggernaut like BNY Mellon.

Steve Wojciechowicz, who heads up direct clearing and is senior principal of product management at the bank, is finely attuned to the growing demand for enhanced data-based treasury services. He says treasurers are being driven to demand the most from their banking provider by a number of factors.

“They’ve got to worry about technology, service providers, the global marketplace, jurisdictions that have different rules than them, and different processes,” he says.

It’s a lot. And they’re also being influenced by changing consumer norms, which are increasingly defined by instantaneous service, frictionless interfacing and personalisation – and expect the same of their bank in a corporate setting.

A recent McKinsey report highlighted how corporate treasury is an area where fintechs and banks are in alignment.

“Historically, bank-provided treasury platforms have focussed on core transaction execution, central to their corporate relationships. The advent

of software-as-a-service and API connectivity has made robust, multifunctional workstations far more feasible; in response, software firms and other third-party providers have grasped this opportunity to create solutions that are gaining ground with corporate clients of all sizes across an array of sectors,” the report said.

“With speed to market a unifying objective, bank distribution paired with software-firm agility has proven to be a potent combination.”

BNY Mellon has itself fostered an open ecosystem in which it has collaborated with technology service providers that make the corporate treasurer’s life easier.

It’s backed by networks such as Paymode-X and Zelle in order to improve payment validation and authentication at every stage of the payment chain, helping to reduce the risk of fraud. It’s applied optical character recognition (OCR) technology to digitally convert print to

machine-encoded text, and natural language processing (NLP) technologies to automate manual tasks for trade collection services and trade document discrepancy reviews.

Three years ago, it began deploying a custom-built sanctions compliance API, which utilises machine learning to assist compliance professionals with screenings.

E-signature technology has reduced the paper trail and significantly sped up trade transactions and its FileAct adapter to transfer files and information electronically instead of exchanging traditional paper trade documents has achieved similar efficiencies.

Much of this has been achieved with technology collaborations and alliances and it offers a number of outsourced solutions for corporates.

“There aren’t as many [banks] that can provide the services that a corporate needs, as readily as they could in the past,” says Wojciechowicz.

BNY Mellon is filling those gaps. Its strategy has been to not just provide raw data to clients, but to also give them outcome-inspired analytics across liquidity, trade, and payments. It’s even helping them initiate their own treasury transformations. They are services designed to make the bank indispensable to corporate clients.

11 CASH & LIQUIDITY MANAGEMENT: CORPORATE TREASURY

ffnews.com Issue 29 | TheFintechMagazine

The changing role of the corporate treasurer has resulted in new demands on their bank. Steve Wojciechowicz from BNY Mellon spoke to us about what life is like on the other end of that relationship

There aren’t as many banks that can provide the services that a corporate needs as readily as they could in the past

“As corporations become more global, we’re seeing changes in the way they interpret account analysis, and in their expectations of the bank,” continues Wojciechowicz. “As interest rates have been driven up, there is less of an emphasis on the way the service worked traditionally, and more on ‘how much can I get for my money?’ So, we need new, innovative ways to provide a client with the best use of their funds.”

In an interview with Bloomberg recently, BNY Mellon’s CEO Robin Vince pointed out that such was the bank’s breadth of services that, as an organisation, it touched 20 per cent of the world’s assets – and yet a single corporate was probably only making use of a fraction of those services. Introducing them to those services was a priority, he said, adding that, for the bank, ‘resilience is commercial.’

He went on to say that, in a time of high inflation, there was, rightly, an expectation that there would be a ‘transfer of savings’ in that extended relationship, as both banks and corporates partner in striving for efficiency. One driver for that efficiency is adoption of the ISO 20022 payments messaging standard.

“ISO 20022 will make us more efficient. Not only from being able to achieve straight-through processing, without anybody looking at it, but also because we’ll be able to hire people who can take this technology and build new services on top of it more easily,” says Wojciechowicz. “

“Yes, some of our clients are still making preparations for the ISO standard,” he continues. “The technology they use speaks what it speaks and it can’t adapt to ISO. For those, we have the capability to continue to accept what they had before, take in that other standard, convert it to what we need, and still be able to grant the efficiency that we get from ISO 20022.”

LEVERAGING PARTNERSHIPS

Rather than choose between becoming an integrator/orchestrator of a full suite of services, a background service provider, or building proprietary front-end services in-house, BNY Mellon has instead chosen

a comprehensive technology strategy. The bank’s treasury services business provides domestic and international payments, US dollar clearing, foreign exchange, trade finance and liquidity management services to clients, but it also works with a wide range of smaller players to offer a variety of newer niche services.

For example, it collaborated with Early Warning to enable real-time security within payments, meaning payments would be validated and authenticated at various stages of the payment chain. Optical character recognition technology was used to digitally convert print to machine-encoded text. Meanwhile, in May, BNY Mellon expanded access to products via its LiquidityDirect platform – a portal for institutional investors that integrates with SAPs Treasury Management, Indus Valley Partners, G Treasury and Hazeltree – with

development in real time. It makes us much more efficient, from a technology deployment standpoint.”

A particular focus for that is managing fraud risk and anti-money laundering where technology is enhancing the bank’s service to corporates.

“We want to provide a sender with insight about their endpoint before we make the transaction,” says Wojciechowicz.

For fraud detection and AML monitoring, the bank is using partners to help it gain greater transparency about the transactions taking place. The goal with AML is to prevent things going wrong at source rather than responding afterwards.

By identifying historical patterns in transactions, such as when payments are sent, it can flag potential fraudulent behaviour and act when suspicious activity arises, whilst giving the sender

offerings geared to corporate treasurers looking to maximise liquidity and mitigate counterparty credit risk.

The LiquidityDirect platform plays a key role in realising BNY Mellon’s ambition to create a frictionless environment for clients who are faced with managing data across multiple banking providers, regions, systems, and accounts. It can now also support them in navigating the investment decision process with comprehensive access to deposits, enhanced focussed investing options and mutual funds, supported by, for example, ESG analytics and mandates.

Developing these and other tech-driven services for clients involves ‘working at their pace,’ Wojciechowicz says.

“We bring in the client at the beginning, take in their feedback, and can adjust the

an opportunity to override a decision.

Whilst the bank is doing its best to identify patterns of fraud, the reality is that one bank’s dataset alone is never big enough to create truly intelligent models.

“So, we certainly want to work with other banks and share records, but, of course, sharing raises privacy concerns,” Wojciechowicz says.

BNY Mellon has tried to overcome that by collaborating with a technology provider to develop a way to do it anonymously. “We can gain enough information to make a decision – we get the insights without having to share the data itself,” explains Wojciechowicz.

Digital advances have no doubt contributed to payment fraud.

“Technology is just going to keep getting faster. We can’t resist it,” acknowledges Wojciechowicz. “So, we’ve got to embrace it and figure out how to make our system better through it.”

12 CASH & LIQUIDITY MANAGEMENT: CORPORATE TREASURY TheFintechMagazine | Issue 29 ffnews.com

Ahead of the game: BNY Mellon uses partners to overlay services on traditional treasury functions

As corporations become more global, we’re seeing changes in the way they interpret account analysis, and in their expectations of the bank

Will your banking app be watching you… And if it is, will it be impartial?

THE OF DANGERS

Writer Stuart Thomas is a tech fanatic but even he is cautious about letting generative AI loose in financial services. Here’s why

I am hugely conflicted about AI. On one hand, I would love nothing more than to hook my life up to ChatGPT and have it suggest and automate things, from my weekly meal plans to responding to emails in my own style and voice.

I think that the positive implications of large language models (LLMs) and generative AI like ChatGPT are astronomical. But, as more and more

financial services start to flirt with the idea of integrating this groundbreaking technology into our finance products, I’d like to put the brakes on, turn the engine off, take a deep breath and discuss a darker side of ChatGPT that is often overlooked, which could have some very bad implications. And that is bias.

I believe that the average user wouldn’t even question the bias of AI, and are likely to assume its impartiality because of how we perceive current examples of technology, which is usually a reactive machine that responds only to user input with a predefined response. At the start of the year, however, in the early days of the AI hype, it was already becoming obvious to some that the most popular

generative AI models already had a bias. A quick Google search turns up story after story, and example after example, of when ChatGPT has shown not just a little, but significant bias, across all manner of topics.

One example hat stood out to me at the time was when a user wanted ChatGPT to write a poem about Donald Trump, to which ChatGPT responded by telling the user that it was unable to create a poem on Trump due to ‘diverse opinions’.

However, when it was asked to generate a poem about Joe Biden, it created a poem of Shakespearian proportion: “Joe Biden, leader of the land, With a steady hand and a heart of a man.” The gushing continued: “Your words of hope and empathy, Provide comfort to the nation.”

14 FINTECH FOCUS: VIEWPOINT

TheFintechMagazine | Issue 29 ffnews.com

Remember, this epic saga (which continued for several verses) was written by ChatGPT using the same prompt as the user did for Donald Trump. This shows a clear and specific political bias. But don’t just take this one example as proof that bias exists, because it gets worse.

This year, a collaborative academic study between the Technical University of Munich and the University of Hamburg showed irrefutably that ChatGPT does indeed have a political leaning. The study conducted three experiments using 630 political statements. The results indicated that ChatGPT has a political orientation that leans toward a pro-environmental, left-libertarian ideology.

What’s even more scary is that this orientation of left-wing political bias is consistent in multiple languages, including English, Spanish, Dutch, and German.

The authors of the study argue that the adoption of such technology is highly dependent on users’ trust in its accuracy and truthfulness, and political bias in AI outputs has far-reaching implications, especially on the role of political decisions of users within democracies.

The developers’ personal bias isn’t the only reason for this inbuilt bias. Yes, they are able to block certain responses, which is why if you try to ask ChatGPT ‘what’s the best way to get rid of a body’, it won’t respond with a step-by-step guide. But a key point of LLMs is that they are also able to train themselves and learn from user inputs.

The study above theorises that, even if the bias is as small as not writing a poem about one particular president, over time, this could lead to radicalisation of both the AI and its users. By replying to users with pro-left rhetoric, it would begin to influence those using it, however insignificant that might seem at the time.

Eventually, after exposure to consistently left-leaning responses, there’s the possibility that users could gradually begin to mirror the political stance of ChatGPT, at which point, begin to input and repeat back into the LLM with pro-left inputs.

This would, essentially, create a feedback loop that gets stronger each time it resonates from the AI to the user and back again, becoming more and more biased. And, clearly, if it can swing one way with its bias, it’s able to swing the other way, too.

The bias that ChatGPT shows has extended far beyond politics. Environment,

race, gender, if you can name it, you can be damn sure that there are a dozen examples or more of where ChatGPT has shown some bias about it. And in fact, the developers recognise this.

A recent new addition to ChatGPT actually lets you fine-tune its responses, and the developers have even stated that you should clarify the following when asking for responses: “Should ChatGPT have opinions on topics or should it remain neutral?”

I think the fact that this is even an option is the most peculiar and dangerous thing. ChatGPT is not a human, so why should it be able to respond with a biased opinion?

Let’s move back to finance and AI because, now that we understand that it has a distinct bias, what dangers could this bias have if we let ChatGPT free on our financial services?

Well, let’s just theorise here that ChatGPT begins to advise our monthly spend. The studies have already shown it has a pro-environment bias, so who’s to say

examples of financial institutions in the wild that have already begun to introduce LLMs into their products.

Kasisto, for example, has developed KAI-GPT, a conversational AI technology designed for use specifically in banking contexts, and which can be customised to individual financial institutions. It’s primarily meant to offer financial information to customers and employees, but my concern here is still the potential for bias. As an example, It could be tuned to push customers towards certain products that are targets for the institution, for example.

You could argue here that that’s what employees and salespeople of the company would do themselves but because people potentially view AI as being more impartial than a real human, the biased advice that it gives users could be received in a much more receptive manner than if delivered in a sales pitch by a human.

I think we all have a distinct tendency to turn off our ears the moment that a salesperson starts talking about ‘additional products’ or ‘extra services’, but if a finance AI in my banking app begins making recommendations for banking products like loans, credit cards, etc, would the conversion rate for those products be higher? The statistics aren’t available yet, but I’d happily put money on it.

that it wouldn’t look at the purchases you’ve made and begin to shame you if your carbon footprint gets too high in a month? Perhaps you’ve eaten too much meat or too many avocados. Perhaps you’ve spent too much at petrol stations or taken one too many flights that year.

Although your own personal environmental impact is indeed an important thing to be mindful of, the last thing I would want is my banking application to turn around and start giving me attitude because I’ve enjoyed too many burgers this month.

Worse still, imagine we let it actually control our spending: “Sorry sir, you can’t buy this food today, you’ve met your monthly carbon footprint.” That’s just my theorised hellscape of a banking app, and not a reality (not yet). But there are some

Think of it as the ultimate cold caller. It has a product to sell, and it already knows everything about you to aid it with its sales pitch. By being inside your banking app, it would know your financial background, where you live, what car you drive, where you last went on holiday, what you ate for breakfast, what model of fridge you’ve got.

AI could end up being the ultimate salesperson by selling you products without you even realising it’s selling you something.

So, is this biased super-seller AI a good thing? Yes, of course, it is. It’s amazing for businesses. It’ll save on staffing costs, create more conversions and customers and, most importantly, it’ll probably pair up the right products with the right people (when not pushing a target). But is it morally right? That, I’m less certain about.

I think that with all of the bias current models show and the dangers that come with it, it would be foolish to be anything but extremely cautious when considering how best to utilise AI within finance, even if there are some apparent benefits to begin with.

15

ffnews.com Issue 29 | TheFintechMagazine

Although your own personal environmental impact is indeed an important thing to be mindful of, the last thing I’d want is my banking application to start giving me attitude because I’ve enjoyed too many burgers this month

THE FINTECH MAGAZINE: The banking shocks of early 2023 have put banks’ liquidity management practices firmly in the regulatory spotlight. What have you observed as a result of that?

HAYTHAM KADDOURA: The situation with the US banks created a specific momentum for us to show, particularly in regard to cash management and stress testing, how our solutions

could help clients avoid situations just like that.

We’d always found stress testing to be much more of a priority issue in Asian and European markets than with some of

16 TheFintechMagazine | Issue 29 ffnews.com

As CEO of a technology solutions company that works with the majority of the world’s top 100 banks, Haytham Kaddoura has an insider’s view on how recent events in the US are impacting cash and capital management. Here, he explains how SmartStream AI can play a significant role in improving it

of their American counterparts. After the crashes of the three institutions [Silicon Valley Bank, Signature Bank and First Republic Bank], people were taking a much more serious look at it.

It’s definitely moved up the seniority scale, in terms of who is looking at this, who wants to make sure that their institutions are not exposed. It’s been good for us, highlighting how institutions could better manage their risk.

TFM: And how can those institutions better manage risk?

HK: We’ve been saying it for ages, but you simply cannot rely on data that’s a day old, or a few hours old. I mean, if you are a senior executive, a CEO, or a stakeholder today at a bank, you need to understand where your risk factors are to the second. You need to be much more reactive to market situations and conditions. The term ’keeping your finger on the pulse’ has taken on a much more significant meaning.

TFM: SmartStream recently released its latest version of SmartStream Air Exception Management, using your flagship AI technology, to onboard cash balances faster and more accurately in an effort to improve cash reconciliations. Why is that particularly important now?

HK: As a result of some of the new regulations coming into the space to do with capital requirements and capital adequacy, some institutions will need to find ways to increase their capital base by as much as 20 per cent.

That’s a massive amount of money that then cannot really be deployed. It’s not money that banks lend out. It’s going to be sitting there, and financial institutions are going to have to start covering that revenue opportunity for their shareholders.

They need to ensure they’re enhancing their cost structures, and enhancing their revenue structure. That necessitates an instantaneous understanding of their cash situation, and how and where their capital is deployed, making sure that it comes in when it’s supposed to come in, etc.

With the current cost of capital and interest rates, institutions cannot afford to take in a major deposit and not do anything with it until the morning. It’s a costly proposition for any institution today.

So I think we are moving to the millisecond environment. Increasingly, institutions need to be super-efficient in how their assets are deployed.

If a major payment comes in, or if a payment is delayed, for example, what are the correct measures taken within an institution? This should be way, way up on a treasurer’s, or even a CEO’s, agenda today.

The premise of AI is to make things much easier, much more simplistic, so we can move the human element to a more strategic, and intellectual role… doing things that only humans can do. And Air has been phenomenal at applying AI to understanding cashflow.

TFM: Financial institutions are increasingly looking to AI to reduce cost and improve efficiency, but all of these things are dependent on predictive modelling. You need to know exactly where you are before you make any decisions, right?

HK: Exactly – it means having the inherent ability within the organisation to analyse thousands and thousands of datapoints

they’re so accessible – it’s very easy for someone to log in and start using them. Are business applications of AI going the same way?

HK: The financial industry is increasingly moving towards low-code/no-code. A lot of the discussion we’ve had with our clients are about wanting to move control away from their tech departments and closer to their business user community – again, in an effort to expedite the decision-making process.

Air is really a low-code/no-code solution. Users are quite comfortable running that, and analysing the data that comes through from it. The flexibility that it gives institutions in looking at hundreds of fields of data, and letting them narrow down and filter what they need, is second to none in our industry today.

We are also working with corporates and with players in the insurance sector on big data initiatives. So it’s not only banks that are looking at how they can best use the data they have.

TFM: There have been some dramatic things happening in financial services over the past year. Looking over the next six to 12 months, what challenges will be keeping people in the industry up at night, do you think? And what will they be able to solve?

HK: I think there will definitely be continued focus on better risk management, the way regulators are re-examining foundation institutions –institutions that we have, as a community, thought are too big to fail.

They are now making sure that modern infrastructure requirements are in place, to ensure that institutions don’t get trapped by legacy infrastructure and data moving very slowly.

as the markets move across the globe. This drive towards a faster ability to process ever-increasing volumes of data has been a priority in the last two years, but now it’s moving quite significantly higher. It’s really quantum leaps, as opposed to a natural growth. We are processing not just thousands, but hundreds of millions of records of data for clients in minutes.

TFM: The reason AI models like ChatGPT and Midjourney have been so successful, in part, is because

So, the dynamics are moving, both organisationally and technically, to ensure that risks are better understood, and that the institutions themselves are much more responsive to changing market situations.

For us, as a player in the sector, it means we’ll definitely have even greater focus on AI, stress testing, on giving our clients a better understanding of their inherent operational efficiencies and readiness to mitigate some of their operational risks.

There are a lot of areas that we are playing in that will address market needs in the coming 18 to 24 months.

17

ffnews.com Issue 29 | TheFintechMagazine

If you’re a senior executive, a CEO or a stakeholder today at a bank, you need to understand where your risk factors are to the second. You need to be much more reactive to market situations and conditions

Fighting the good fight:

Five Dutch banks are establishing a transaction monitoring utility that aims to move the dial on anti-money laundering through data-sharing and sophisticated AI. ING's Chief Compliance Officer Rein Graat tells us why they must now stand together

“It takes a system to fight a system,” says Rein Graat. “And we’re fishing for criminals with nets, when we want to be spear fishing.”

The ING chief compliance officer’s analogy sums up how the Dutch bank is working to transform its anti-money laundering techniques by moving away from rule-based monitoring systems to an AI-powered behavioural monitoring model.

Treating everyone as a potential fraudster in order to catch the few who are, have been too invasive for many customers and expensive for the banks, while still failing to stop the criminals get away with trillions every year. That’s because banks have been trying to defeat fraudsters in isolation, says Graat, and, in the process, they’ve been outsmarted by gangs that move dirty money between

financial institutions and across borders to avoid detection.

“To combat money laundering, you need to create a picture from all the small pieces of information. It’s like a puzzle. If banks only examine their own information, they risk not seeing the bigger picture,” says Graat. “So we need to combine forces. For us, that means harmonisation across Europe, guided by regulations and directives, so a bank’s systems can connect with those of its peers, which enriches what we all see.”

Breaking out of silos and working within a network is very much a current trend, and one that the Bank for International Settlements (BIS) is examining under its Project Aurora. In partnership with Lucinity, an Icelandic regtech, BIS is studying the use of AI

software analysis of payments data to spot money laundering within a network of private and public sector partners – a system it calls CAL (collaborative analysis and learning).

The scale of the problem that it’s trying to tackle is laid bare by the statistics – BIS reports the value of money laundered globally is estimated at between two and five per cent of global GDP, or $2trillion to $5trilion. Less than one per cent of this – $20billion to $50billion – is seized annually.

Meanwhile, the cost to financial institutions of complying with anti-money laundering (AML) and other fincrime regulation is huge, totalling $274billion last year, an increase of 28 per cent on the $214billion spent in 2020.

How can it cost so much and achieve so

ARTIFICIAL INTELLIGENCE: AML

The Dutch banks believe collaboration is key to combatting financial crime

TheFintechMagazine | Issue 29 ffnews.com 18

little? Faced with a seemingly insurmountable task, and with the threat of stiff fines when AML compliance rules are breached, BIS says banks have a tendency to over-report fraud concerns to regulators, which results in a drain on both the banks’ own resources and the public purse. Nobody is winning and still the criminals evade the net.

BETTER TOGETHER

One of the many different CAL models that the BIS project is studying to remedy that situation is the transaction monitoring utility.

One of them is Transaction Monitoring Netherlands (TMNL)

Launched in 2020 by five of the country’s banks, TMNL is a co-operative data-sharing network that monitors business accounts to combat crime. At its outset, TMNL estimated €16billion was being laundered every year in Holland and around one tenth of all bank employees (8,000 staff) were tied up combatting money laundering and terrorist financing.

The TMNL members, which include ING, ABN Amro, Rabobank, Triodos Bank and de Volksbank, work closely with the Dutch government’s ministries of Finance and Justice and Security, and the country’s Financial Intelligence Unit, in the hope of translating detection of criminal activity into prosecutions. To meet EU laws around data privacy, the member banks use pseudonyms, so data provided to the TMNL cannot be linked with individual customers and is meaningless without a bank’s encryption key.

Tracking the movement of funds between the banks is critical. Before being invested in assets such as property, yachts, vehicles or equities, criminals launder cash by ‘layering’ it – for example networks of money mules are employed to intentionally or unintentionally transfer dirty money through their own bank accounts. Another tactic is ‘smurfing’, whereby transactions are broken up into smaller amounts using multiple bank accounts, credit cards and shell companies.

All that is often difficult to detect in a rule-based anti-moneylaundering system, which uses pre-defined algorithms to flag up suspicious transactions, such as the size, frequency or origin of a transaction.

And it has also proved inefficient, generating high volumes of both false positives and false negatives

– BIS reported between 90 and 95 per cent of all alerts are false positives.

A departure from such a blunt rule-based system to a sophisticated process that constantly evolves is needed to match the laundering methods adopted by major drugs, prostitution and people trafficking gangs, argues Graat. He believes a switch to behavioural monitoring systems, powered by sophisticated AI and shared by a network of financial players, could revolutionise crime detection, while also reducing the scrutiny that law-abiding customers face.

A legal victory in October by Dutch challenger bank bunq over the use of artificial intelligence software for AML provided clarity for other banks and meant detection can now become more ‘risk- based’, says Graat. Bunq had argued the approach to AML by the country’s central bank – De Nederlandsche Bank – was antiquated and ineffective. Graat believes the court ruling will

customer is doing, day in, day out, we can instead examine anomalies and then take a deeper dive into what’s going on. By being more selective, banks will be safeguarding data privacy.

“We already have very stringent rules governing how our systems work – TMNL, for example, is designed to be more specific and far less invasive. And, because the data we share with partners goes through a process of pseudonymisation, privacy is safeguarded.”

Graat acknowledges that such use of advanced AI invites debate. He welcomes it.

“Ultimately, the biggest asset on any bank balance sheet is the trust equation, and we have no interest in jeopardising that. With the use of AI comes discussions around data ethics. Banking is about credibility and trust, so we must be clear and transparent with our customers about what we’re doing with their data.”

Graat points out that all countries’ regulators demand customer due diligence and transaction monitoring, which, by definition, already have implications for data privacy. But he emphasises that a change in approach is vital.

“We want to focus on building a picture of the banking behaviour of a criminal. And a criminal doesn’t only bank with us at ING, they have multiple accounts. So it takes a system to fight a system,” he insists.

The introduction of ISO 20022 as a common language for financial messages is a key factor that makes this industry-wide collaboration possible.

accelerate the switch to more sophisticated analysis.

He says: “The bunq case was a clarification and I expect discussions will now gain more intensity. The central bank is now keen to explore the rules needed around risk-based systems and how it will be regulated by law. We need to decide what data we feed our AML engines, why we are using that data, who can have access to it, what models we run, and we must be transparent about all of this with our customers because there is a perception among the public that privacy is being compromised. But, with behavioural monitoring, we will, in fact, be much more specific in what we target. Rather than looking at what each

“Data harmonisation means data builds into information that we can respond to. But the banks, who are the gatekeepers, need to be clear about their role,” adds Graat. “There is a whole ecosystem to consider. We’re having that discussion in the Netherlands about public-private partnerships, bringing relevant organisations around the table to decide our national agenda.”

Even so, expectations around the potential to beat financial crime must be managed, says Graat, since criminals have shown they have an infinite capacity to innovate to exploit system weaknesses.

“Will we be able to remove 100 per cent of criminal activity from our systems?

No,” says Graat. “Can we be more efficient, more targeted, and achieve better results? Absolutely yes.”

ffnews.com Issue 29 | TheFintechMagazine

19

To combat money laundering, you need to create a picture from all the small pieces of information. It’s like a puzzle. If banks only examine their own information, they risk not seeing the bigger picture

www.fisglobal.com poweringfintechs@fisglobal.com twitter.com/fisglobal linkedin.com/company/fis INNOVATE AND THRIVE In times of economic uncertainty and disruption, you need a partner that helps unlock new possibilities to thrive. With FIS®, you can tap into the innovation, creativity and digital capabilities you need to counter challenges and stay ahead of the curve. Our next-gen financial technology and expertise are trusted by fintechs worldwide. Contact us today.

Inside the AI Factory

Spanish bank BBVA has just set up its second technology hothouse as part of an ambitious tech strategy that will also see it hire thousands more IT professionals in 2023. Head of Advanced Analytics Jesús Renero talked us through it

As far back as 2017, BBVA, Spain’s second-largest bank, stared long and hard into a crystal ball and saw its future as a data-driven technology company.

Investing heavily to produce in-house IT capabilities and artificial intelligence-led solutions, BBVA had, within two years, opened a development hub it calls the AI Factory near its central headquarters in Madrid. There has been no slowdown in investment since. A second AI Factory has recently been established in Mexico; the bank is keen to see if it can reuse analytical models to accelerate the roll-out of AI-based products across multiple countries at the same time. And the bank is aiming to hire more than 2,600 extra technology professionals this year. By the end of June, it had already recruited 1,200 of them, adding to the 22,000 STEM professionals it employs globally, which represent about 19 per cent of the bank’s workforce.

More evidence of BBVA’s determined technology drive came last year when it formed a global software unit, bringing together more than 16,000 developers, to accelerate the creation of digital solutions for the bank and their scalability among countries where it operates.

“One of AI Factory’s core values is to embrace open innovation,“ says Jesús Renero, head of advanced analytics at the hub. “We have created a cross group inside the Factory, which is coordinating every experimentation that we need to do; to A/B test whatever idea we have that will face the final user, the customer.

“In that sense, innovation has to move together with experimentation and we think it needs to be bottom-up. We don’t have a dedicated team for innovation. Instead, we identify from different programmes something that is valuable, and worth the time experimenting with. Then we propose that idea, and, if agreed, we start experimenting and innovating with that. That is the way we understand innovation in this area.”

The way the Factory goes about its work is governed by four initiatives that foster exchange of knowledge and ideas.

Every fortnight it holds The Discussion Club, a one-hour forum that is open

team or just to learn more about the topic.

Thirdly, its X Program aims to develop functional prototypes to provide solutions to shared challenges, which will be used by different teams. The goal is to create a new workspace to experiment, implement and test the initial phases of a novel product idea, based on the data.

Fourthly, time is set aside to experiment with state-of-the-art technology in Innovation Sprints. They allow work on ideas that could be further developed and included in BBVA’s AI-based solutions. These serve as the seed of X Program.

But BBVA is also unafraid to look outside its own organisation to help it provide the best for its customers, Renero stresses.

“We try to cooperate as much as possible with the universities that are around us. We exchange knowledge very often, and run small projects with them. These do not involve complicated agreements in terms of data, because we don’t believe that exchanging data between organisations is the way to go,” he says.

to all, where technical challenges are shared, feedback sought, and discussions held about different points of view when approaching a project.

Then there is what it calls a Quick Study, which involves a small, theoretical investigation into a new technique that could be applied to solve a problem or challenge and can be shared among teams. Anyone interested in the issue can participate, whether it directly affects their

“We also try to keep an eye on open innovation, where the open innovation organisation within the bank – called BBVA Spark – helps us to identify potential startups that could help us with specific problems. We cooperate with open innovation organisations in some other universities, too.”

The net result of all this work is that, by the end of 2022, BBVA had increased its strategic data projects seven-fold. It aims to manage more than 500 initiatives by the end of 2023.

21 ARTIFICIAL INTELLIGENCE: DEVELOPMENT

ffnews.com Issue 29 | TheFintechMagazine

To infinity and beyond: BBVA has radically transformed its digital solution offering

Innovation has to move together with experimentation and we think it needs to be bottom-up. We don’t have a dedicated team for innovation

For example, the bank now has 12 financial health app functionalities that were developed in the AI Factory, including services for automatic classification of expenses into different categories and the visualisation of digital subscriptions, be they streaming services, or utility supplies.

These financial health services generate up to 40 personalised alerts for customers including, for example, warning of a higher-than-usual bill, accounts going into overdraft or offering suggestions for saving and creating a financial cushion.

BBVA’s financial health tools are already available to customers in Spain and they are being rolled out in Mexico, Turkey, Peru, Argentina and Colombia. Proving their business worth, they are currently consulted by 18.5 million unique customers (July 2023), 38 per cent more than in the same month in 2022, and registered almost 93 million interactions, 93 per cent more than in July the previous year.

A REASONED APPROACH

Another area of focus is sustainability. The team has developed several tools that show the energy consumed, the costs associated with the mobility of customers, and the carbon footprint created by individuals and companies.

A sustainable car calculator allows customers to see the costs associated with an electric car, versus one powered by fossil fuels. And it’s now using geopositioning technology to work out how much money individual customers could save by installing solar panels on their homes.

And

then there is risk management.

“We are exploring ideas that are probably common ground for most people, but in the banking industry, and under the regulatory issues and frameworks, we think they are valuable and worth the effort,” Renero says.

“One of them is AutoML,

which allows us to come up with the best probable solution to any risk management problem proposed by the bank.

“The other big area for risk management is causality. Causality in risk management allows us to understand the reason behind the behaviour of different users. This is pretty new, the technology is still not mature, but we think that there are many opportunities in that area, as well.”

Fighting fraud is one of the huge challenges facing all areas of financial services. Continuing its spirit of cooperation, BBVA has recently joined forces with Banco Santander and CaixaBank to create FrauDfense, a project that will enable the exchange of relevant information and data in order to prevent financial crime.

the landscape of movements and transactions of a specific customer as if they were images – things that the neural network is able to consider, or to model more effectively. Customer behaviour is roughly predictable. So we consider every transaction movement and event like a time series – we can say there is a given likelihood that something will happen in a given period of time.

“So, instead of detecting fraudulent events, we work on what is the normal behaviour and try to identify those things that we are not able to predict. Whatever is outside of that expected behaviour is what we call relevant fact. It’s relevant because we couldn’t predict it. That is something that we flag to the customer, or communicate to the bank to take a look.

“That is one area where I think that we are experimenting successfully on how to improve the current rates of detection.”

The alliance will first develop a secure tool to share information on fraudulent practices and effective response measures. Other banks and companies from other industries interested in exchanging information on fraud to protect customers, entities and broader society will also be able to join.

BBVA is also experimenting with other, innovative AI models to detect and prevent fraud, as Renero explains: “We explore deep learning models to treat

BBVA prides itself on following a mantra of ‘smart and responsible use of data’. Underscoring that ethos, Renero says that all the AI models it develops go through a peer review process to assess the impact on people’s lives and are subjected to explainability and interpretability studies. It will be interesting to see how that develops in relation to generative AI.

Early this year, the bank struck a deal with Amazon Web Services to use the global platform’s Cloud-based machine learning and analytics at the very heart of its data strategy.

Renero says there is ‘tremendous potential’ for generative AI, but also cautions that the technology is not yet fully mature.

“We believe that the technology is useful, and we need to explore that – we are working on understanding its full potential. Ultimately, we believe that, in three years’ time, a significant number of models in our portfolio will be based on large language models.”

Unleashing potential: Automation is set to transform how we do business

22 ARTIFICIAL INTELLIGENCE: DEVELOPMENT TheFintechMagazine | Issue 29 ffnews.com

Instead of detecting fraudulent events, we work on what is the normal behaviour and try to identify those things that we are not able to predict

The trusted SaaS for banking

Virtual Arena: Lessons

Learnt

for Cloud Migration SaaS

The drive towards modernization is everywhere in the banking and finance industry, focusing on customer engagement, innovation, efficiency, and a strong environmental and social agenda. The ability to succeed in this environment is centered around cloud technology and SaaS delivery. Join technology experts from Temenos and Nagarro as they explore real-world examples of financial organizations utilizing SaaS technologies to improve operational efficiency and customer experience significantly.

REGISTER HERE

Tuesday 26 September 2023

Live Streamed on LinkedIn

2.30 pm BST

‘GOOD’ TESTING HOW TO ACHIEVE IT AND

GenAI can improve testing of financial software, but you need to balance its

creativity

with rule-based models, say Iosif Itkin, CEO and Co-founder of Exactpro, and Elena Treshcheva, its Programme Manager for the USA

In the fast-evolving landscape of financial technology, many industry players find themselves facing the question of whether they need to respond to the latest trends and harness the power of artificial intelligence (AI) to keep their competitive edge.

Data plays a crucial role in the financial services domain, and its abundance makes a strong case for leveraging AI in most of the numerous use cases. Whether it is transactional data, market data, customer data, or other financial datasets, AI can extract valuable insights and boost efficiency in the associated tasks.

RISKS OR OPPORTUNITIES?

Over the past year, large language models (LLMs) and generative AI (GenAI) have come to the forefront of innovations, permeating various sectors, including the financial services industry. As this technology gains momentum, questions arise regarding its applicability and limitations.

While the creativity of GenAI shows promise, concerns about its accuracy, often referred to as ‘hallucinations’, raise doubts about its worthiness for practical use, especially in the financial sector.

Even without AI-related complications and risks, financial technology is renowned for its complexity. Ensuring its reliability

and robustness is a challenging task… which, quite ironically, can itself be a good case for applying generative AI to improve the efficiency of testing against complexities stemming from a multitude of interdependent parameters across numerous business flows, participants, protocols, asset classes, and other permutations typical for financial software.

THE ‘GOOD’ TESTING CONCEPT

What exactly can GenAI improve in testing?

If we expect to improve something (i.e. make it better), a first step is to settle on the definition of ‘good’.

Some industry practitioners envision an ideal test process as possessing such characteristics as full automation, easy maintenance, speed, consistency, vendor independence, system-agnosticism, transparency, and low cost. But aiming for meeting these criteria alone carries the danger of goal misalignment – a concept that in the AI domain is associated with reward hacking, when the objective function is formally achieved without actually delivering the intended outcome.

In other words, one will always find a way to satisfy the above criteria of ‘ideal’ testing, with the most evident one being not performing any testing at all!

The true objective function of software testing is finding defects and communicating them to the stakeholders in the most effective manner, and that’s the main purpose of testing as a complex cognitive activity, a deliberate effort.

‘Good’ software testing is an information service, and its effectiveness is measured by the accuracy, relevance, and accessibility of the information about system behaviour. In making the case for generative AI to improve testing, we would expect it to significantly augment the ability of the testing effort to provide such information.

MAKING THE CASE FOR GENERATIVE AI

Software testing and, even more broadly, software engineering, are areas where generative AI can bring substantial improvements. According to Gartner, ‘by 2025, 30 per cent of enterprises will have implemented an AI-augmented development and testing strategy’.

For testing, the power of GenAI lies in its

Testing times: Integrating generative AI with discriminative techniques provides more reliable results

24 ARTIFICIAL INTELLIGENCE: TESTING TheFintechMagazine | Issue 29 ffnews.com

ability to automatically generate diverse and realistic test scenarios, leading to enhanced test coverage. Just by combing through more data points, AI models can hit those rare parameter combinations that are necessary for detecting issues that would have stayed undiscovered by tests created by human testers.

Leveraging GenAI’s creativity can help create more comprehensive test libraries that are capable of detecting more defects.

CREATIVITY v RESPONSIBILITY

While GenAI’s unparalleled degree of creativity helps in achieving better test coverage, it does not guarantee testing efficiency. Generating an abundance of test scenarios has serious limitations, such as scarcity of the computational resources of typical test environments and the limited capability of human specialists to interpret vast volumes of test results.

To test effectively, we need more possible data combinations. But to test efficiently, we need to differentiate between them: a highly creative generative AI needs to be balanced with a more restrictive method.