Amid Another Worst Quarter Ever for U.S. Pay TV, Even YouTube TV Lost Subscribers in Q1, Analyst Says

Craig Moffett says advertisers are now fleeing linear for streaming, too, taking even more marquee content and eyeballs with them

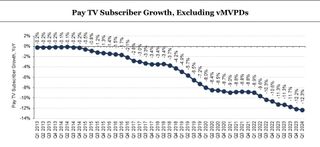

"Stop us if you’ve heard this one before," self-aware equity analyst Craig Moffett told investors Tuesday in his firm's quarterly "Cord Cutting Monitor" report. "The first quarter was the worst ever for pay TV subscriber losses."

True, erosion to the U.S. subscription linear video ecosystem accelerated to an all-time high of 12.3% from January - March. But that isn't the only reason the first quarter stood out as being particularly bad for this declining business.

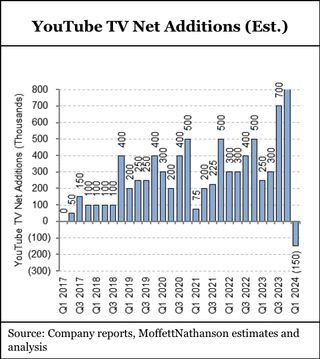

For one, the MoffettNathanson equity analyst wrote, "even YouTube TV, the only real 'winner' thus far in linear video’s dismantling, posted its first-ever quarterly subscriber loss by our estimate, underscoring the growing seasonality of the increasingly sports-driven linear vMVPDs."

With the NFL signing off in February, Moffett estimates that many users cancelled the very churn-able streaming service, resulting in an estimated loss of 150,000 YouTube TV subscribers. (Google/YouTube parent company Alphabet very seldomly releases subscriber numbers for YouTube TV.)

Virtual MVPDs now control around 30% of U.S. pay TV subscribers, Moffett estimates, and will own a market share of around 50% by 2028, he predicts.

But in the first quarter, every major vMVPD service lost subscribers, he noted.

Also read: With DirecTV Now Shrinking at Nearly 17%, MoffettNathanson Says Pay TV Has Entered the ‘Doom Cycle'

NEXT TV NEWSLETTER

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

A year ago, Moffett introduced his investor clients to the concept of the "Doom Cycle." Actually, there were two of them.

In one of these virtuous cycles, rising costs for sports programming drives entertainment-focused users out of the pay TV ecosystem, causing sports programmers to increase their content price even more to make up for the lost revenue ... causing yet more subscribers to cut the cord.

In the other circle, entertainment companies -- faced with declining distribution in the pay TV ecosystem -- "strip mine" more and more of their marquee entertainment content and license it to direct-to-consumer streaming. That causes even more pay TV customers to ... yup, cut the cord.

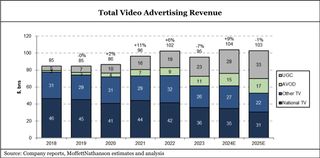

Now, with YouTube (the mothership, not the vMVPD) controlling an ever greater portion of overall viewing time -- "a MrBeast video rivals unscripted shows found on broadcast," Moffett points out -- advertisers are also leaving linear to chase streaming, causing more content and eyeballs to follow the exodus towards the money.

"As ad-supported SVOD and AVOD continue to scale and their targeting capabilities grow more sophisticated, so too will the ad dollars generated from them, and so too will the incentive to feed them an even greater share of content," Moffett wrote.

"With ad dollars excluding UGC continuing to fall even in the face of total video advertising (including UGC) continuing to grow, we fully expect companies to continue spinning this third wheel, migrating eyeballs out of pay TV for good," he added.

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!