- News

- Business News

- India Business News

- Railway stocks in focus: How Titagarh Wagons, RVNL, other rail stocks gave up to 1,800% returns under Ashwini Vaishnaw

Trending

Railway stocks in focus: How Titagarh Wagons, RVNL, other rail stocks gave up to 1,800% returns under Ashwini Vaishnaw

Railway sector stocks have seen significant returns under the Modi government. The top performers include privately owned Titagarh Rail and public sector undertakings like RVNL and IRFC, with substantial gains in profits.

The strong performance of railway stocks can be attributed to the government's renewed focus on the sector. (AI image)

Railway stocks: Ashwini Vaishnaw's continuation as the Railway Minister in the Modi 3.0 government is expected to bring renewed attention to stocks in the railway sector, many of which have delivered impressive returns over the past year.

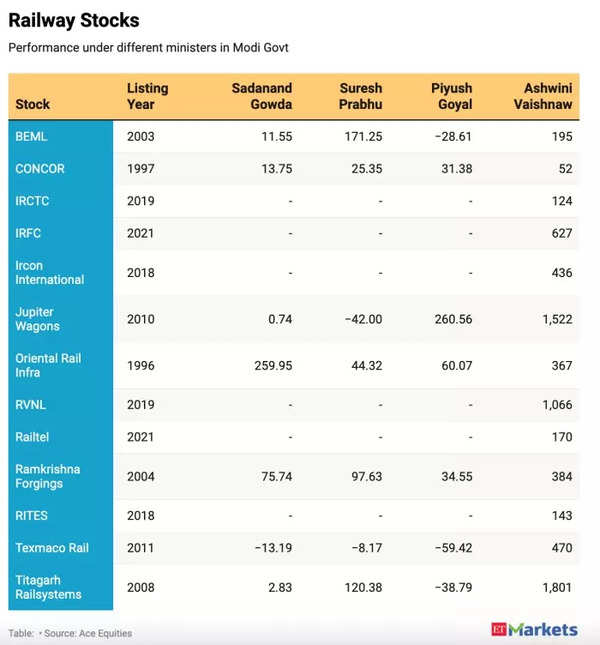

An analysis of the performance of railway sector stocks during the tenures of the four railway ministers in the previous two governments - D.V.Sadananda Gowda, Suresh Prabhu, Piyush Goyal, and Ashwini Vaishnaw - has been done by ETMarkets.

Of these, Gowda had the shortest tenure, serving from May 26, 2014, to November 9, 2014, as the first minister to take charge of this important ministry. Suresh Prabhu followed, with a tenure lasting from November 9, 2014, to September 3, 2017. Piyush Goyal then held the office from September 4, 2017, to July 7, 2021, and Vaishnaw has been at the helm since July 7, 2021.

During Vaishnaw's tenure, several state-run railway companies, including IRCTC, IRFC, Ircon, RVNL, Railtel, and RITES, were listed on the stock exchanges.

Titagarh Rail, a privately owned company, has been the top performer, delivering over 1,800% returns since Vaishnaw took over. The company has consistently reported quarter-on-quarter growth in its net profit, with a standalone PAT of Rs 79 crore in Q4FY24, up 64% year-on-year. Jupiter Wagons, another star performer, reported a 153% YoY increase in PAT, reaching Rs 104 crore in the January-March quarter.

Among the PSU railway stocks, RVNL has gained 1066%, backed by solid performance. The company's net profit rose 26% YoY, from Rs 345 crore in Q4FY23 to Rs 433 crore in Q4FY24.

IRFC has also seen a multibagger rally of 627%, supported by strong YoY and QoQ earnings growth. Its PAT increased by 33% to Rs 1,717 crore in Q4FY24, up from Rs 1,285 crore in Q4FY23.

Vinit Bolinjkar, an analyst at Ventura Securities, believes that the power and railway sectors could remain in prime focus due to the huge demand and recommends investors maintain long positions in these sectors.

Also Read | ‘Vande Bharat Bullet Train’ soon? Indian Railways looks to roll out ‘Make in India’ bullet trains with 250 kmph speed this year

Amisha Vora, Chairperson & MD of Prabhudas Lilladher, is of the view that the long-term growth story of India's railway sector remains intact despite the ongoing correction. She views the correction in railways, power, and capital goods as a positive development that will bring more reasonable valuations to these sectors.

According to Nilesh Jain, AVP of Equity Research Technical and Derivatives at Centrum Broking, the railway space is currently experiencing consolidation, which he expects to persist in the near term. He recommends adding stocks like IRCTC, RVNL, and Railtel on dips and holding them if already in possession.

An analysis of the performance of railway sector stocks during the tenures of the four railway ministers in the previous two governments - D.V.Sadananda Gowda, Suresh Prabhu, Piyush Goyal, and Ashwini Vaishnaw - has been done by ETMarkets.

Of these, Gowda had the shortest tenure, serving from May 26, 2014, to November 9, 2014, as the first minister to take charge of this important ministry. Suresh Prabhu followed, with a tenure lasting from November 9, 2014, to September 3, 2017. Piyush Goyal then held the office from September 4, 2017, to July 7, 2021, and Vaishnaw has been at the helm since July 7, 2021.

During Vaishnaw's tenure, several state-run railway companies, including IRCTC, IRFC, Ircon, RVNL, Railtel, and RITES, were listed on the stock exchanges.

The strong performance of railway stocks can be attributed to the government's renewed focus on the sector, resulting in growing order books and improved earnings.

Performance of Railway Stocks

Titagarh Rail, a privately owned company, has been the top performer, delivering over 1,800% returns since Vaishnaw took over. The company has consistently reported quarter-on-quarter growth in its net profit, with a standalone PAT of Rs 79 crore in Q4FY24, up 64% year-on-year. Jupiter Wagons, another star performer, reported a 153% YoY increase in PAT, reaching Rs 104 crore in the January-March quarter.

Among the PSU railway stocks, RVNL has gained 1066%, backed by solid performance. The company's net profit rose 26% YoY, from Rs 345 crore in Q4FY23 to Rs 433 crore in Q4FY24.

IRFC has also seen a multibagger rally of 627%, supported by strong YoY and QoQ earnings growth. Its PAT increased by 33% to Rs 1,717 crore in Q4FY24, up from Rs 1,285 crore in Q4FY23.

Vinit Bolinjkar, an analyst at Ventura Securities, believes that the power and railway sectors could remain in prime focus due to the huge demand and recommends investors maintain long positions in these sectors.

Also Read | ‘Vande Bharat Bullet Train’ soon? Indian Railways looks to roll out ‘Make in India’ bullet trains with 250 kmph speed this year

Amisha Vora, Chairperson & MD of Prabhudas Lilladher, is of the view that the long-term growth story of India's railway sector remains intact despite the ongoing correction. She views the correction in railways, power, and capital goods as a positive development that will bring more reasonable valuations to these sectors.

According to Nilesh Jain, AVP of Equity Research Technical and Derivatives at Centrum Broking, the railway space is currently experiencing consolidation, which he expects to persist in the near term. He recommends adding stocks like IRCTC, RVNL, and Railtel on dips and holding them if already in possession.

End of Article

FOLLOW US ON SOCIAL MEDIA